straight life policy cash value

Maximize your cash settlement. Dont settle for a low offer.

Importance Of Insurance Insurance Underwriting Income Protection

It also provides the.

. It has the lowest annual premium of the three types of Whole. Abacus Will Help Guide You To Decide If A Life Settlement Is The Right Choice For You. Cash value accumulation of both 20-Pay Life and Straight.

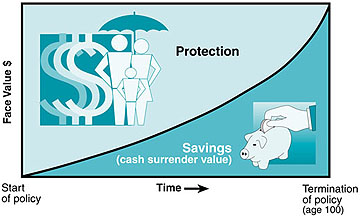

While a life insurance policy itself isnt considered an investment its a financial asset the cash value of a straight life policy grows like an investment. Turn Your Policy into Cash Today. The whole life provides lifelong coverage and includes an investment component known as the policys cash value.

Get the info you need. Ad Cash in your life insurance policy. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest.

Variable life insurance is a type of permanent life insurance with a cash value and with investment options that work like a mutual fund. Maximize your cash settlement. See if you qualify in under 10 Minutes.

Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest. A straight life insurance policy often known as whole life insurance has a cash value account that increases in size as you pay premiums into the plan. 20-Pay Life accumulates cash value faster than Straight Life.

Ad Do you have over 100K in life insurance. Get the info you need. See if you qualify in under 10 Minutes.

A straight life insurance policy can also build cash value over time. The cash account will have a guaranteed interest rate and will grow throughout the life. When you pay premiums a portion of it goes toward the upkeep of your life insurance policy while the.

It usually develops cash value by the end of the third policy yearC. Every time you pay. Ad Abacus Life Settlements Has Been Ranked At The Top Of The Industry For Over 17 Years.

Ad Sell Your Life Policy to the Highest Bidder. Get a quote from a licensed life settlement specialist. Welcome Funds Auction Secures the Best Offer.

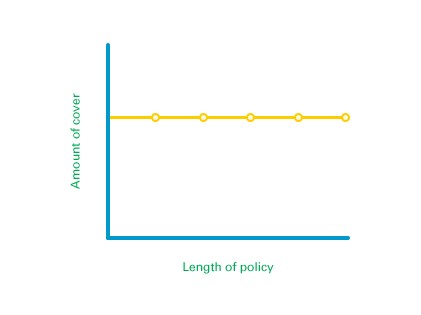

As a form of permanent life insurance straight life insurance comes with a cash value account that will grow over the life of the plan. Straight Whole Life Insurance Provides Permanent Level Protection Level Premiums and Cash Value Accumulation For the Life of the Policy. A straight life insurance policy can also build cash value over time.

The cash value is an interest-earning account inside of your straight life insurance policy. A straight life policy is. A life insurance policys cash value is separate from the death benefit so your beneficiaries would not receive the cash value if you passed away.

The face value of the policy is paid to the insured at age 100B. Straight life accumulates faster than Limited-pay Life. Universal life insurance is a type of.

The cash value grows slowly tax-deferred meaning you wont pay taxes on. Straight Whole Life Insuranceor ordinary life. Any cash value thats left in.

4 rows A straight life insurance policy can also build cash value over time. A straight life insurance policy can also accumulate cash value over time. Use It For a Better Life Retirement.

Ad Cash in your life insurance policy. The rate of return will typically be large enough that.

Depreciation Cost Residual Value Useful Life Depreciation Book Value X Depreciation Rat Business Tax Deductions Accounting Principles Business Tax

The Amount Of Life Insurance Needed Depends On Each Person S Specific Situation There Are Many Factors To Consider In In 2021 Financial Planner Investing Legal Help

How Do Life Insurance Pay Outs Work Legal General

Life Insurance Purposes And Basic Policies Mu Extension

Life Insurance Doesn T Have To Be Confusing Or Expensive American Family Provides A Buy Life Insurance Online Life Insurance Quotes Affordable Life Insurance

What To Know About Cash Value Life Insurance Forbes Advisor

Company Disputed Claim Autos Send Covering Letter Accident This Convenient Way Formally Love Is

What To Know About Cash Value Life Insurance Forbes Advisor

How Much Life Insurance Do I Need After I Retire Lifeinsurance Lifeinsurancebenefits L Life Insurance Facts Universal Life Insurance Whole Life Insurance

How Whole Life Insurance Works Permanent Life Insurance Whole Life Insurance Life Insurance Policy

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Lcx Life A Life Insurance Settlement Company Life Life Insurance Health Challenge

Life Insurance Quotes From 6 100 Gift Card Legal General

7 Words Insurance Agents Should Never Use Insurance Agent Insurance Marketing Expensive Quotes

Depreciation Cost Residual Value Useful Life Depreciation Book Value X Depreciation Rat Business Tax Deductions Accounting Principles Business Tax

:max_bytes(150000):strip_icc()/best-whole-life-insurance-4845955_final-c60b6733837046e5a5213deb9e87ccd5.png)

Best Whole Life Insurance Companies Of 2022

What Is Whole Life Insurance Cost Types Faqs

The Amount Of Life Insurance Needed Depends On Each Person S Specific Situation There Are Many Factors To Consider In In 2021 Financial Planner Investing Legal Help